Long-Term Disability

When faced with a long-term illness or injury, the absence from work can lead to severe financial difficulties. Long-Term Disability benefits provide a safety net, ensuring that our Members can continue to support themselves and their families when they find themselves sick or injured and unable to work for long periods of time.

Get Started

Enrollment is simple and only takes a few minutes.

Information you will need

– Employment & Income Information

– Spouse & Dependent Dates of Birth & Contact Information

– Bank Account & Routing Numbers

Plan Details

Guaranteed Approved Coverage. You cannot be denied during open enrollment.

Pre-existing conditions are covered after 12 months of continuous coverage.

Benefit election cannot exceed 60% of annual income.

Loss of DOT Certification or FAA Medical Certification due to medical reasons is covered.

Stackable with other eligible benefits, up to 70% of pre-disability earnings.

Benefits paid are tax-free.

24/7 coverage for on and off the job disabilities caused by injuries, illnesses or surgeries.

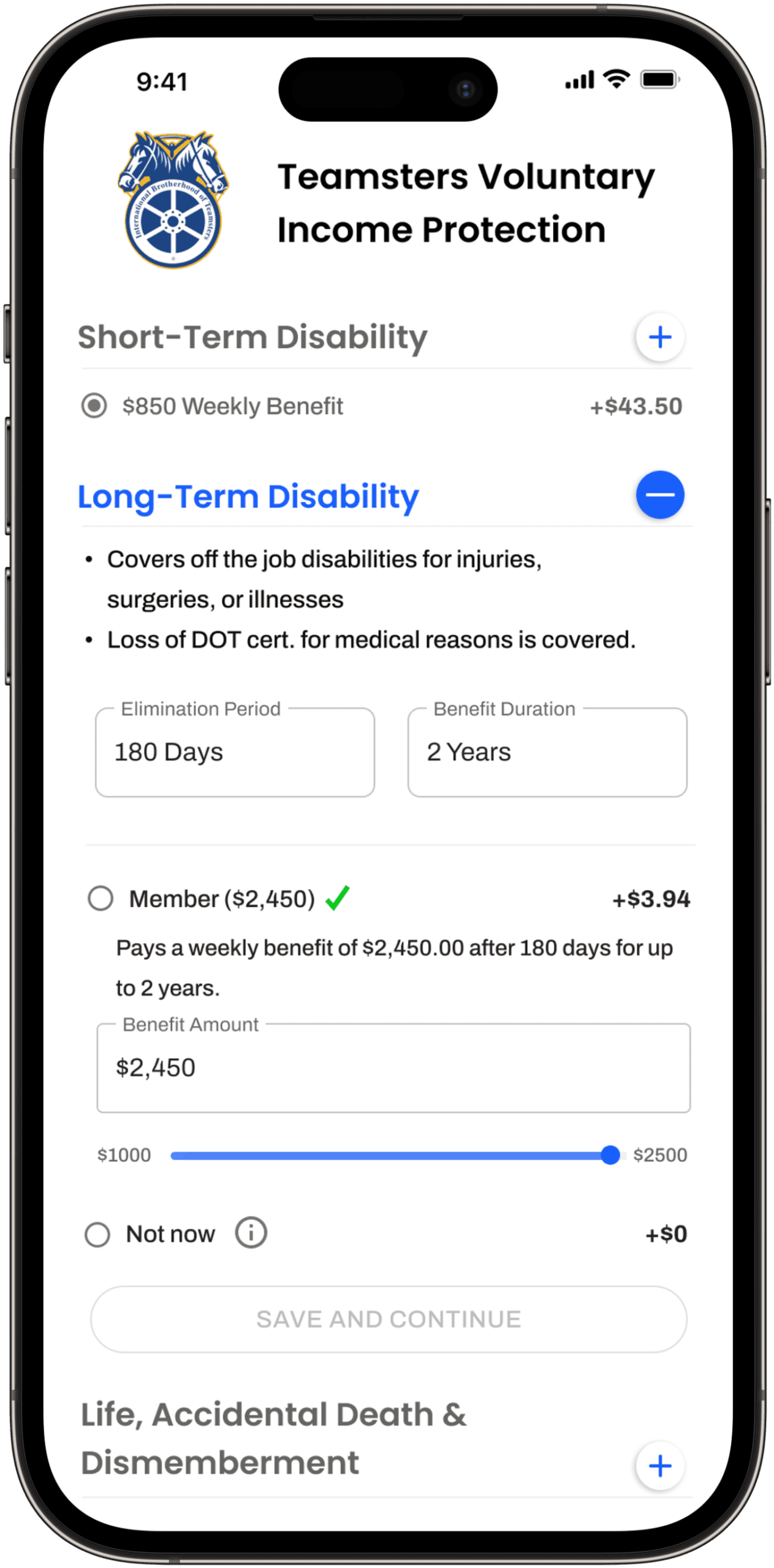

LTD OPTION 1

AVAILABLE TO FULL-TIME AND PART-TIME MEMBERS

Pays a flat monthly benefit for up to 2 years. Pays after 180 days waiting period.

Short-Term Disability covers first 26 weeks.

COVERAGES |

MONTHLY COSTS BY AGE BRACKET |

|||||||||||||||||||||||||

MAX MONTHLY BENEFIT* |

18-29 |

30-39 |

40-49 |

50-59 |

60-69 |

70-79 |

||||||||||||||||||||

$1,500 |

$2.80 | $5.05 | $9.10 | $18.25 | $33.85 | $33.85 | ||||||||||||||||||||

$2,000 |

$3.40 | $6.40 | $11.80 | $24.00 | $44.80 | $44.80 | ||||||||||||||||||||

$2,500 |

$4.00 | $7.75 | $14.50 | $29.75 | $55.75 | $55.75 | ||||||||||||||||||||

*For additional benefit amounts not shown, please click here for the Cost Calculator.

LTD OPTION 2

AVAILABLE TO FULL-TIME MEMBERS ONLY

Pays a flat monthly benefit for up to 5 years. Pays after 180 days waiting period.

Short-Term Disability covers first 26 weeks.

COVERAGES |

MONTHLY COSTS BY AGE BRACKET |

|||||||||||||||||||||||

MAX MONTHLY BENEFIT* |

18-29 |

30-39 |

40-49 |

50-59 |

60-69 |

70-79 |

||||||||||||||||||

$3,000 |

$7.90 | $18.40 | $40.60 | $85.60 | $103.30 | $103.30 | ||||||||||||||||||

$4,000 |

$10.20 | $24.20 | $53.80 | $113.80 | $137.40 | $137.40 | ||||||||||||||||||

$5,000 |

$12.50 | $30.00 | $67.00 | $142.00 | $171.50 | $171.50 | ||||||||||||||||||

$6,000 |

$14.80 | $35.80 | $80.20 | $170.20 | $205.60 | $205.60 | ||||||||||||||||||

$7,000 |

$17.10 | $41.60 | $93.40 | $198.40 | $239.70 | $239.70 | ||||||||||||||||||

$7,500 |

$18.25 | $44.50 | $100.00 | $212.50 | $256.75 | $256.75 | ||||||||||||||||||

*For additional benefit amounts not shown, please click here for the Cost Calculator.

IMPORTANT INFORMATION ABOUT THIS PLAN

IMPORTANT: The monthly cost for coverage is based on your age at the start of the coverage and will increase on the policy anniversary date after you move into a new age bracket. This benefits guide is tailored for Members aged 18-79. If you depart from the IBT, opt out of paying dues, or retire, you must notify the Teamsters VIP+ administrative office at (224) 770-5304. You have 30 days to notify us of your retirement if you wish to port or convert your Life Insurance. Not doing so within 90 days could delay or negate your eligibility for a refund.

Participation in this program is voluntary, and the decision to enroll rests solely with the Members. Members are responsible for bearing all associated costs. A $1 technology fee is included in all listed monthly costs for the following coverages: Short-Term Disability, Long-Term Disability, Member Life, and Spouse Life.

We encourage Members to thoroughly review the complete policy booklet, email info@teamstersVIP.com to request a copy, if you did not receive one upon enrollment.

This program is administered by Union One Benefits Administration.

For AD&D, STD & LTD: THIS IS AN EXCEPTED BENEFITS POLICY. IT PROVIDES COVERAGE ONLY FOR THE LIMITED BENEFITS OR SERVICES SPECIFIED IN THE POLICY.

For STD & LTD: These policies provide disability income insurance only and do NOT provide basic hospital, basic medical, or major medical insurance as defined by the New York State Department of Financial Services.

North Carolina Residents: THIS IS NOT A MEDICARE SUPPLEMENT PLAN. If you are eligible for Medicare, review the Guide to Health Insurance for People with Medicare, which is available from the company.

Group Insurance coverages are issued by The Prudential Insurance Company of America, a Prudential Financial company, Newark, NJ. The Booklet-Certificate contains all details, including any policy exclusions, limitations, and restrictions, which may apply. Contract Series: 83500.

Prudential, the Prudential logo, and the Rock symbol are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.