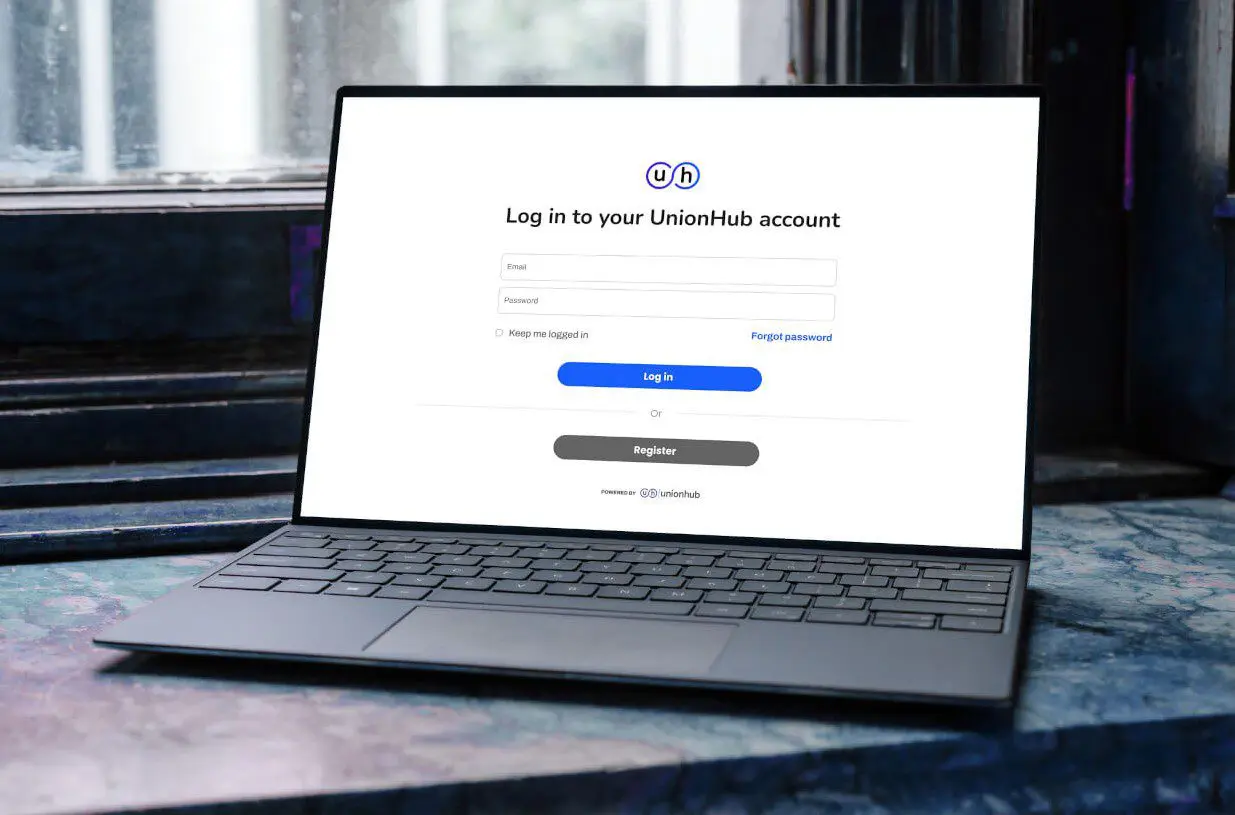

UnionHub:

Simplifying Access to Your Benefits

Welcome to UnionHub, a seamless solution for accessing your union and income protection benefits. At TeamstersVIP.com, we understand the importance of convenience and security in managing your benefits and payments. That’s why we have partnered with UnionHub, a platform that revolutionizes how you interact with your benefits.

Why UnionHub?

No App Downloads Required

UnionHub is designed for ease. You don’t need to download any apps; access everything directly and swiftly.

Trusted Nationwide

Serving thousands of clients across the country, UnionHub is renowned for its reliability and security.

Secure and User-Friendly

We prioritize your security and ease of use. With UnionHub, managing your benefits is straightforward and safe.

Proudly U.S.-Based

Our team, based in Denver and Chicago, is composed of industry-leading professionals. Every aspect of UnionHub, from programming to security protocols, is crafted with precision and expertise, showcasing the best of domestic talent.

Your Secure Gateway to Benefits

TeamstersVIP.com, in collaboration with UnionHub, offers you an unrivaled platform for handling your benefits and payments. It’s not just a tool; it’s your secure gateway to a hassle-free experience with your Teamster Voluntary Income Protection benefits.

IMPORTANT INFORMATION ABOUT THIS PLAN

IMPORTANT: The monthly cost for coverage is based on your age at the start of the coverage and will increase on the policy anniversary date after you move into a new age bracket. This benefits guide is tailored for Members aged 18-79. If you depart from the IBT, opt out of paying dues, or retire, you must notify the Teamsters VIP+ administrative office at (224) 770-5304. You have 30 days to notify us of your retirement if you wish to port or convert your Life Insurance. Not doing so within 90 days could delay or negate your eligibility for a refund.

Participation in this program is voluntary, and the decision to enroll rests solely with the Members. Members are responsible for bearing all associated costs. A $1 technology fee is included in all listed monthly costs for the following coverages: Short-Term Disability, Long-Term Disability, Member Life, and Spouse Life.

We encourage Members to thoroughly review the complete policy booklet, email info@teamstersVIP.com to request a copy, if you did not receive one upon enrollment.

This program is administered by Union One Benefits Administration.

For AD&D, STD & LTD: THIS IS AN EXCEPTED BENEFITS POLICY. IT PROVIDES COVERAGE ONLY FOR THE LIMITED BENEFITS OR SERVICES SPECIFIED IN THE POLICY.

For STD & LTD: These policies provide disability income insurance only and do NOT provide basic hospital, basic medical, or major medical insurance as defined by the New York State Department of Financial Services.

North Carolina Residents: THIS IS NOT A MEDICARE SUPPLEMENT PLAN. If you are eligible for Medicare, review the Guide to Health Insurance for People with Medicare, which is available from the company.

Group Insurance coverages are issued by The Prudential Insurance Company of America, a Prudential Financial company, Newark, NJ. The Booklet-Certificate contains all details, including any policy exclusions, limitations, and restrictions, which may apply. Contract Series: 83500.

Prudential, the Prudential logo, and the Rock symbol are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.